Are you on the fence about selling your house? While affordability is improving this year, it’s still tight. And that may be on your mind. But understanding your home equity could be the key to making your decision easier. An article from Bankrate explains:

“Home equity is the difference between your home's value and the amount you still owe on your mortgage. It represents the paid-off portion of your home.

You'll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. You'll also build equity over time as your home's value increases.”

Think of equity as a simple math equation. It's the value of your home now minus what you owe on your mortgage. And guess what? Recently, your equity has probably grown more than you think.

In the past few years, home prices skyrocketed, which means your home's value – and your equity – likely shot up, too. So, you may have more equity than you realize.

How To Make the Most of Your Home Equity Right Now

If you're thinking about moving, the equity you have in your home could be a big help. According to CoreLogic:

“. . . the average U.S. homeowner with a mortgage still has more than $300,000 in equity . . .”

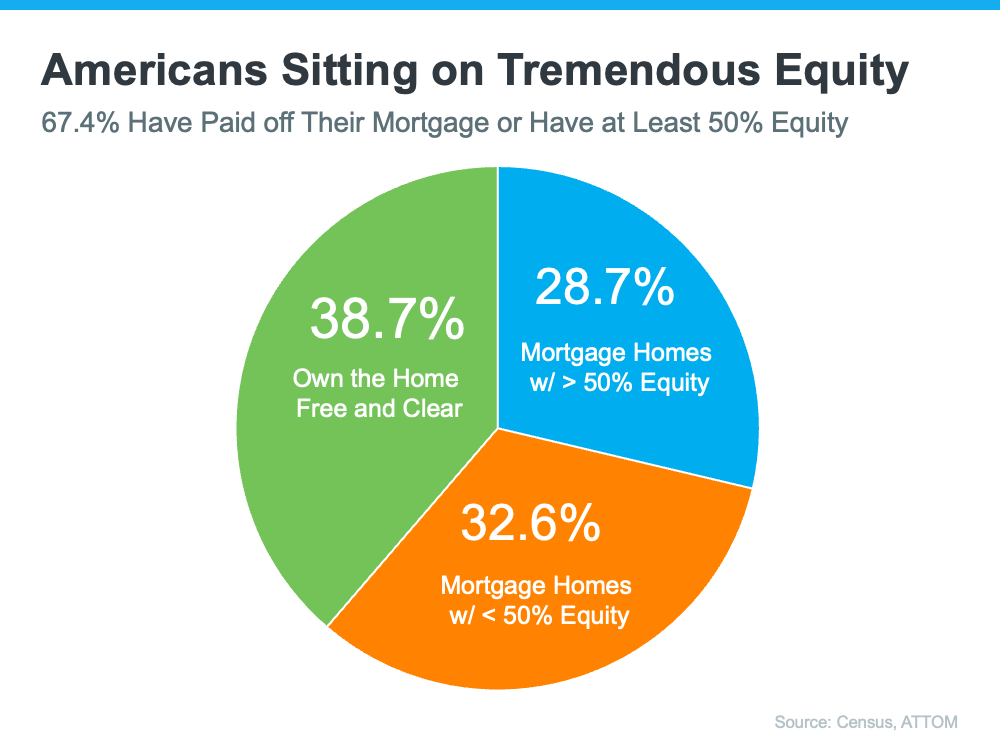

Clearly, homeowners have a lot of equity right now. And the latest data from the Census and ATTOM shows over two-thirds of homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means roughly 70% have a tremendous amount of equity right now.

After you sell your house, you can use your equity to help you buy your next home. Here’s how:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates. Investopedia states:

“You may want to pay cash for your home if you're shopping in a competitive housing market, or if you'd like to save money on mortgage interest. It could help you close a deal and beat out other buyers.”

- Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much money. The Mortgage Reports explains:

“Borrowers who put down more money typically receive better interest rates from lenders. This is due to the fact that a larger down payment lowers the lender’s risk because the borrower has more equity in the home from the beginning.”

The Easy Way To Find Out How Much Equity You Have

Reach out to us today for a personalized Comparative Market Analysis (CMA) and discover the true value of your home in today's market. This detailed analysis will provide you with a precise understanding of your property's value in the context of the current market, taking into account the unique characteristics of your home and the latest trends in your area.

Bottom Line

Leveraging home equity is not just about capitalizing on a financial advantage; it's about strategically positioning oneself for future success. As we navigate through the complexities of the real estate market, understanding and utilizing home equity can significantly alter the course of your property's sale, transforming it from a mere transaction into a pivotal financial milestone. We have witnessed firsthand the game-changing potential of well-managed equity. It empowers sellers, offering them not just an opportunity for profit, but a stepping stone towards achieving their long-term real estate aspirations. Whether you're scaling up, downsizing, or transitioning to a new chapter, the strategic use of home equity can be your greatest ally. Remember, in the dynamic world of real estate, knowledge is not just power—it's profit. Let's navigate this journey together, ensuring that your home's equity works as hard for you as you have for it.